What Program Is Used to Determine Employee's Bonuses

For example you might give a spot bonus for going above and beyond or for providing exceptional customer service. To calculate an employee bonus based on a designated sum divided equally divide the sum by the number of employees receiving the bonus.

Salary Increase Templates 10 Free Printable Excel Word Pdf Salary Increase Sign In Sheet Template Free Certificate Templates

This is an indicator that works using a calculation that ensures greater relevance to recent data that is there is a weighting factor that ensures that weights are differentiated since it uses the multiplication of factors to differentiate weights in relation to different data.

. Under the FLSA all compensation for hours worked services rendered or performance is included in the regular rate of pay. Abosch recalls one company that had well over 100 metrics for its incentives. When you prorate you use the same parameters you would use for your long-term employees but adjust the bonus based on the number of.

PayScale says 39 of companies use spot bonuses which as the name suggests are given on the spot to reward desirable behavior. At big companies spot bonuses can be several thousand dollars. To calulate a bonus based on your employees salary just multiply the employees salary by your bonus percentage.

Creating an incentive program at your startup. It is called the employee bonus program or employee bonus plan. For example a monthly salary of 3000 with a 10 bonus would be 300.

This is highly encouraged for. If you have a 401k plan check on your policy are bonuses included in matching funds. Goals for your bonus program should be focused on what drives success in your business.

Enter the following expression into G7 the commission. Annual bonuses are the most common type of bonuses provided to employees. One very basic type of bonus program is current profit sharing.

To allocate a designated sum based on the number of hours each employee worked add up the total number of hours that each employee worked. These are given at the end. There are many different types of bonus and incentive programs you can create for your employees.

The most commonly used programs include. An employee bonus plan which is also often referred to as an employee incentive plan is essentially a document that contains the companys plan for the payments of bonuses to its employees on an annual basis. For that there should be a system or a plan in place.

Create a detailed payment formula that can be applied consistently and that everyone can understand. Build a budget to see the overall picture of how things should play out. Referral bonuses are payments that employees receive in exchange for connecting their employer with a candidate for an open position.

Sales-related commission or bonus programs. Profit-sharing Profit-sharing is one of the most common employee bonus plans seen in todays workplace. Those are great accomplishments that often warrant some sort of recognition and reward from the employer.

A typical bonus percentage would be 25 and 75 percent of payroll but sometimes as high as 15 percent as a bonus on top of base salary. A company sets aside a predetermined amount. Here are a few options.

You can decide to pay quarterly semiannual or annual bonuses. First we need a new table. Apart from annual bonuses profit sharing schemes are also a common type of bonus programs.

Sign-on bonuses are commonly seen in sales roles. Get rid of hit-or-miss bonuses. This can involve receiving a professional designation certification or licensure that the employee had been working toward or even being recognized with an award or other honor that brings some positive light and attention to your company.

The Act provides an exhaustive list of payments. A performance bonus is related to the employees contribution to achieving company goals. You will have to increase the bonus amount for this to work.

Payroll software can ensure that correct amounts for bonuses end up in bank accounts appropriate taxes are withheld and line items align accurately with the general ledger. If the grade of the employee is not 17 or above that is grade sixteen or below then else block will be executed and the bonus will be computed as bonus 30 of salary. For example a monthly salary of 3000 with a 10 bonus would be 300.

A sign-on or signing bonus is a sum of money paid to new employees upon hire and is determined while negotiating a job offer. Lets review the primary types of employee bonus program examples. Simply copy the Table and remove the data.

A bonus is a payment made in addition to the employees regular earnings. Now we use the if-else statement to determine that the grade is 17 or above. Employers use this type of bonus as an incentive to garner more interest in open positions.

If you want your employees to receive a specific bonus amount after taxes you can use the tax gross-up method to determine how much of a bonus you need to give. If so we calculate bonus 60 of salary. The healthiest way to provide employee bonuses is to base the reward on overall company performance and profitability to get everyone on the same page.

Use a budget to stay realistic. Choose a Bonus Schedule Select a bonus schedule. A seniority plan rewards employees with a higher bonus each year they work for your company.

10 Types of the Bonus Program for Employee 1. To determine employee bonuses companies use the weighted moving average program. There are many different types making it critical for your businesss leadership to work together to determine what kind of bonus or bonuses will work best to motivate your employees.

These bonuses range widelya bonus could be 50 or up to 15 of an employees salary. Your company sets aside a predetermined percentage of its earnings often between 25 and 75 of its payroll but not more than 25. Figure B shows a matching Table object with no data or expressions.

Such a plan is worthless in terms of creating focus. Weve even included employee bonus program examples to give you an idea of how a program could look for your business. First of all the user will input salary of the employee along with grade.

Profit-sharing incentive plans are usually based on a percentage of the employees salary but can also be a percentage of earnings or a flat rate that is split among employees. Compensation management software can align performance goals and compensation budgets to determine optimal payouts.

How To Calculate Your Employee Year End Bonus

4 Bonus Structure Templates Free Sample Templates Sample Resume Templates Proposal Templates

Differentiating Bonus With Performance

How To Calculate Your Employee Year End Bonus

Event Checklist Printable How To Create An Event Checklist Printable Download Event Planning Checklist Planning Checklist Event Planning Checklist Templates

Types Of Employee Recognition And Rewards Bonusly

47 Sample Monthly Sales Plan Templates In Pdf Ms Word Inside Quality Weekly Operations Meeting Agenda Te In 2021 Agenda Template Meeting Agenda Template Meeting Agenda

Incentive Compensation What Are The Different Types Of Bonuses

Incentive Compensation Plans Merit Pay Piece Rates Commissions Bonuses Skills Based Video Lesson Transcript Study Com

Kurt Lewis S Force Field Analysis Was Devised To Assist Administrators In Developing Implementing Managing Change Plans That Analysis Change Management Force

10 Types Of Employee Bonus That Your Workforce Will Adore

Download Teacher Salary Slip Excel Format Exceltemple Teacher Salary Teacher Help Free Resume Template Word

Creating An Esop Employee Stock Ownership Plan Exit Strategy How To Plan

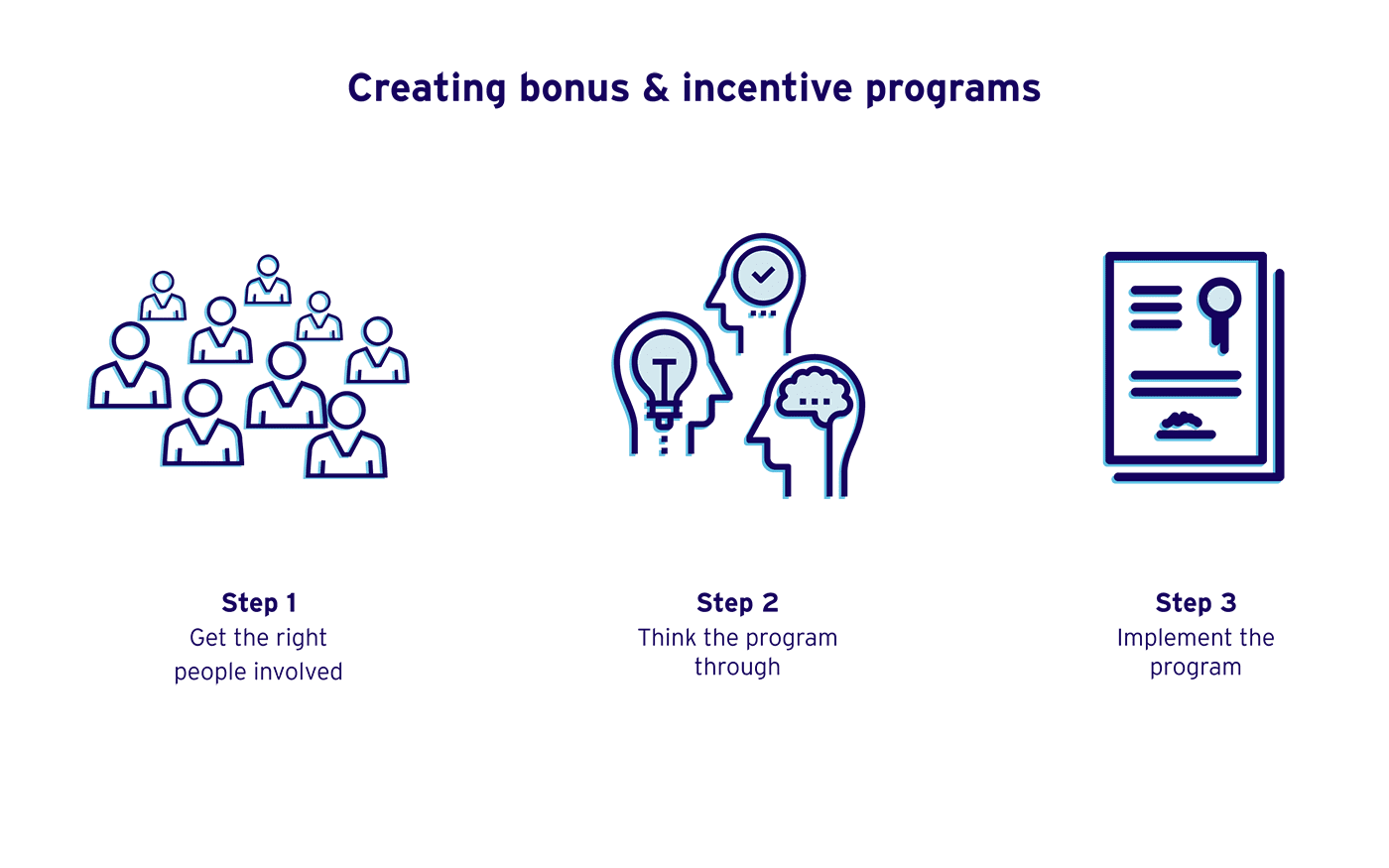

Creating Employee Bonus Incentive Programs

Mini Prize Wheel With 12 Slots Printable Templates Countertop Black Prize Wheel Spinning Wheel Template Printable

Bonus Plan Template Excel Best Of 4 Bonus Structure Templates Formats Examples In Word Excel Incentives For Employees How To Plan Employee Incentive Programs

Q Write A C Program To Calculate Bonus On Salary Grade Wise Program Statement Write A C Program To Input Salary Programming Tutorial Salary Programming